Car Hire Excess - Ireland

- Details

- Written by: maryia

- Category: Car Hire Excess

- Hits: 66

- Claim Submit Section Main Title: <span class="dark-sky">Gigasure app</span>, the fastest way to make a claim

- Secure today title: Secure today your Car Hire <br> Excess Insurance policy <br> for your Irish road trip!

- Secure today image desktop:

- Secure today image mobile:

- Useful Information title: Useful Information for Driving in Ireland

- Useful Information description: When travelling to Ireland, Car Hire Excess insurance protects you from unexpected costs related to your hired car, but it is also important to consider travel insurance for complete peace of mind. Travel insurance provides cover for medical emergencies, trip cancellations, lost baggage, and other unforeseen events, ensuring that you are fully protected throughout your journey.

- Useful Information learn more text: Learn more about Europe Travel Insurance

- Useful Information article text: Other useful articles:

- Useful Information image list:

- Useful Information image title:

Thinking About Hiring a Car Abroad? Here's Everything..., Useful Information image:

, Useful Information image title link:

https://gigasure.com/blog/car-hire-insights/thinking-about-hiring-a-car-abroad-heres-everything-you-need-to-know

, Useful Information image title link:

https://gigasure.com/blog/car-hire-insights/thinking-about-hiring-a-car-abroad-heres-everything-you-need-to-know - Useful Information image title:

Off-Airport Car Hire: The Pros, Cons, and Cautionary Tales..., Useful Information image:

, Useful Information image title link:

https://gigasure.com/blog/car-hire-insights/off-airport-car-hire-the-pros-cons-and-cautionary-tales-you-need-to-know

, Useful Information image title link:

https://gigasure.com/blog/car-hire-insights/off-airport-car-hire-the-pros-cons-and-cautionary-tales-you-need-to-know - Useful Information image title:

How to Save Money on Car Hire: A Comprehensive Guide, Useful Information image:

, Useful Information image title link:

https://gigasure.com/blog/car-hire-insights/how-to-save-on-car-hire

, Useful Information image title link:

https://gigasure.com/blog/car-hire-insights/how-to-save-on-car-hire

- Useful Information image title:

Thinking About Hiring a Car Abroad? Here's Everything..., Useful Information image:

- Learn more link: https://gigasure.com/europe

- FAQ Landing Main Title: Your frequently asked questions answered

- FAQ Landing Content List:

- FAQ Landing Content List Title:

Why do I need Car Hire Excess Insurance in Ireland? , FAQ Landing Content List Description:

Driving in Ireland is an awesome way to explore this small but mighty country, offering efficiency and freedom without being bound to strict schedules often demanded by public transport. Picture yourself cruising freely along Ireland’s scenic roads, no strict schedules or timetables holding you back. But beware: a car hire excess could unexpectedly throw a wrench in your plans and no one wants that. In Ireland, most rental deals come with basic insurance that carries a steep excess, often between €1,000 and €2,500, covering damage or theft. So, if your rental car ends up with a scratch, dent, or worse, stolen, you might find yourself on the hook for thousands of euros. Even small mishaps aren’t cheap: expect around €250 for a scratched door, €300 for a flat tyre, and up to €750 if your windscreen cracks. These little bumps in the road happen to the best drivers, but they can still hit your wallet hard!

Car Hire Excess Insurance can save you a significant amount by covering costs that would otherwise come out of your pocket. Getting excess cover from an independent provider like Gigasure is usually much more cost-effective than purchasing the rental company’s insurance. In Ireland, car hire desks are known to push their “super CDW” or excess waiver add-ons quite hard, but they often charge two to three times more than independent options.

Opting for Gigasure means you can skip the upsell at the rental counter and still enjoy strong, reliable protection. It’s also worth noting that many rental company waivers come with limitations, often excluding things like tyre or glass damage or leaving room for surprise terms in the fine print. Gigasure fills in those gaps, so you’re properly covered.

On top of that, cities like Dublin, while great, are known for busy traffic and tight parking, which naturally increases the chances of minor scrapes or bumps. Having excess insurance in place helps you avoid the stress of unexpected repair bills that can sometimes climb above €1,500. Hopefully you won’t run into any issues during your trip, but it’s always smart to be prepared—just in case.

- FAQ Landing Content List Title:

Is Car Hire Excess Insurance worth it in Ireland? , FAQ Landing Content List Description:

Yes, it is! Considering just how high excess on Irish car hires, excess insurance is well worth that extra peace of mind you get. The cost of an independent policy is relatively low, often around £2–£5 per day for a standalone cover (or even less if you buy an annual plan), which is minor compared to a possible €1,500 or higher charge you’d face for an accident. Think of it as a small charge for being able to not worry about what could go wrong. Car hire companies charge a lot for their own excess waiver (sometimes €20+ per day, which adds up to £150+ a week), so independent cover can pay for itself even if you never make a claim. And if you do need to claim for any damage, you can easily save hundreds or thousands of euros. In Ireland’s driving conditions (busy city traffic, unfamiliar roads, tight parking spots, particularly in the larger cities), the likelihood of small incidents is not negligible. Having excess insurance means you can relax and enjoy your road trip, knowing you are protected from certain unpleasant experiences.

- FAQ Landing Content List Title:

What do I need to hire a car in Ireland? , FAQ Landing Content List Description:

Exploring Turkey by car is an affordable and popular way to get around. From the stunning coastlines to the lively cities, it gives you the freedom to travel on your own schedule. But there’s one thing that often catches travellers off guard: the high excess fees that come with most car hire agreements. These fees can seriously impact your budget if something goes wrong.

In Turkey, rental cars typically come with basic insurance, but the excess (or deductible) you’re responsible for can range from €1,000 to €2,500 in the case of damage or theft. Unfortunately, even small mishaps can lead to surprisingly large charges. A scratched door might set you back €250, a punctured tyre around €300, and a cracked windscreen could cost up to €750. These aren’t rare accidents either — they can happen to any driver, no matter how careful.

That’s where Car Hire Excess Insurance comes in. With a policy from an independent provider like Gigasure, you’re protected from those costly fees without having to fork out for the expensive insurance options sold at the rental desk. In Turkey, rental companies often try to upsell “super CDW” or excess waivers, but these can cost two to three times more than a standalone policy.

Choosing Gigasure means you get better value and more complete protection. While rental company waivers often exclude common problem areas like tyres, glass, and the underside of the vehicle, Gigasure is proud to offer these as standard.

- FAQ Landing Content List Title:

How much is the excess on hired cars in Ireland? , FAQ Landing Content List Description:

In Ireland, the excess on rental cars typically falls between €1,500 and €2,000, depending on the type of vehicle and the car hire company. This sum is generally held on your credit card as a security deposit for the duration of your rental and is released once the car is returned undamaged. Remember that even a small scratch can constitute damage.

However, don’t forget that if the car is damaged (even in minor cases like a scratched panel) or stolen, you could be responsible for paying that excess! To protect against this potential expense, many travellers choose Car Hire Excess Insurance. It can reimburse you for the excess amount charged by the car hire company, helping you avoid unexpected costs and giving you greater peace of mind during your trip.

- FAQ Landing Content List Title: Why is hiring a car in Ireland so expensive? , FAQ Landing Content List Description: Renting a car in Ireland often ends up costing more than expected. Several factors drive up the price: high insurance costs, seasonal spikes in demand, and a relatively limited number of available vehicles. Most rental companies include a large excess fee, usually between €1,500 and €2,000, unless you pay extra for additional cover. Prices can climb even further during peak travel seasons, especially in summer when demand regularly outpaces supply. If you’re looking for an automatic vehicle, be prepared to pay more, as they’re less common than manuals in Ireland. Add-on charges like young driver fees, airport collection, and optional insurance upgrades can also make the final bill noticeably steeper. All in all, these combined elements explain why car hire in Ireland can be pricier than many travellers anticipate so it’s very important to factor these in.

- FAQ Landing Content List Title: Can’t I just rely on my credit card or travel insurance for this? , FAQ Landing Content List Description: Some premium credit cards (or bank accounts) do offer car hire damage cover, and a few travel insurance policies include a hire car excess waiver as an add-on. It’s worth checking the fine print if you think you have such cover. However, be cautious: credit card cover often comes with strict conditions (e.g. you must decline the car hire company’s CDW and use that card for the rental, and there may be exclusions or lower limits). Travel insurance car hire cover might not be as comprehensive – often it has lower claim limits or excludes certain damage (like to tyres or windscreens). Gigasure’s Car Hire Excess Insurance is a dedicated policy, so it’s specifically designed for this scenario: high-claim limits, covering all the tricky exclusions, and easy, quick claims handling. It can serve as your primary solution or as a supplementary safety net if you don’t want to risk gaps in cover. In short, while some travellers have protection via cards or travel insurance, many prefer the certainty and broad cover of a specialist policy when driving in Ireland.

- FAQ Landing Content List Title:

Why do I need Car Hire Excess Insurance in Ireland? , FAQ Landing Content List Description:

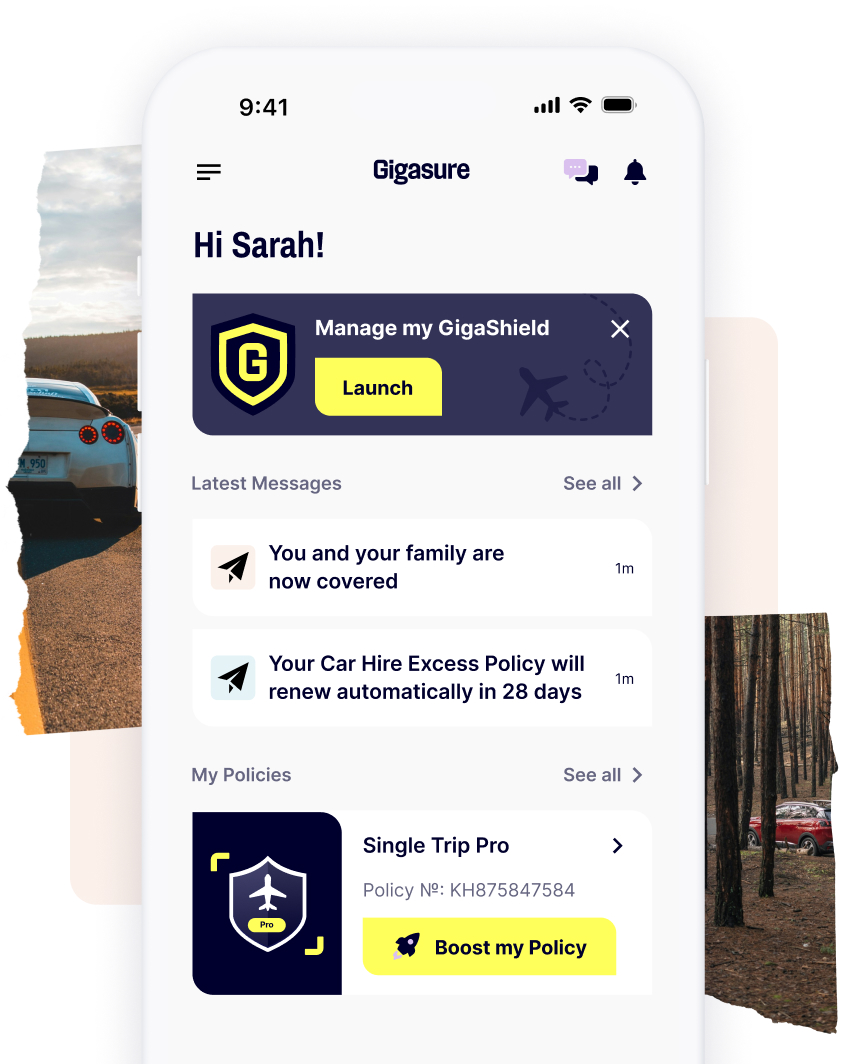

- Boost Main Title: <span class="dark-sand">Gigasure app</span>, your travel companion

- Boost Main Description:

With the Gigasure app, you can purchase new policies,

manage your existing ones, and access your documents

anytime, anywhere. - Boost Main Image:

- Claim Submit Section Main Description:

The Gigasure app takes the hassle out of submitting claims. Simply log in, select the relevant policy,

and kickstart the process. The app pre-populates most of the required information available on your

account, eliminating the need to search through old emails or documents. From there, just follow

the remaining steps, and you can submit your claim in moments. It's a seamless, streamlined

experience that gets your claim submitted quickly, saving you valuable time and frustration. - Claim Submit Section Image:

- Claim Submit Section Steps:

- Claim Submit Section Step Title: Your Policy, Claim Submit Section Step Description: Find and select your policy

- Claim Submit Section Step Title: Your Trip, Claim Submit Section Step Description: Provide details <br>of your trip

- Claim Submit Section Step Title: Your Claim, Claim Submit Section Step Description: Tell us more <br>about the claim

- Claim Submit Section Step Title: Supporting Documents, Claim Submit Section Step Description: Attach all your claim <br>supporting documents

- Claim Submit Section Step Title: Submit, Claim Submit Section Step Description: Add your payment <br>details and submit your <br>claim

- Benefits Main Title: Benefits of buying Car Hire Excess <br> Insurance when travelling to Ireland

- Benefits Image 1:

- Benefits Image 2:

- Benefits Content 1:

Financial Protection: Car Hire Excess Insurance for Ireland offers financial cover for the excess amount you would be liable for in the event of damage, theft, or loss of the rental vehicle. Irish car hire agreements typically include Collision Damage Waiver (CDW), with a damage/theft excess of €1,000–€2,500. Avoid steep car hire car excess charges; Gigasure’s policy ensures you won’t pay out of pocket.

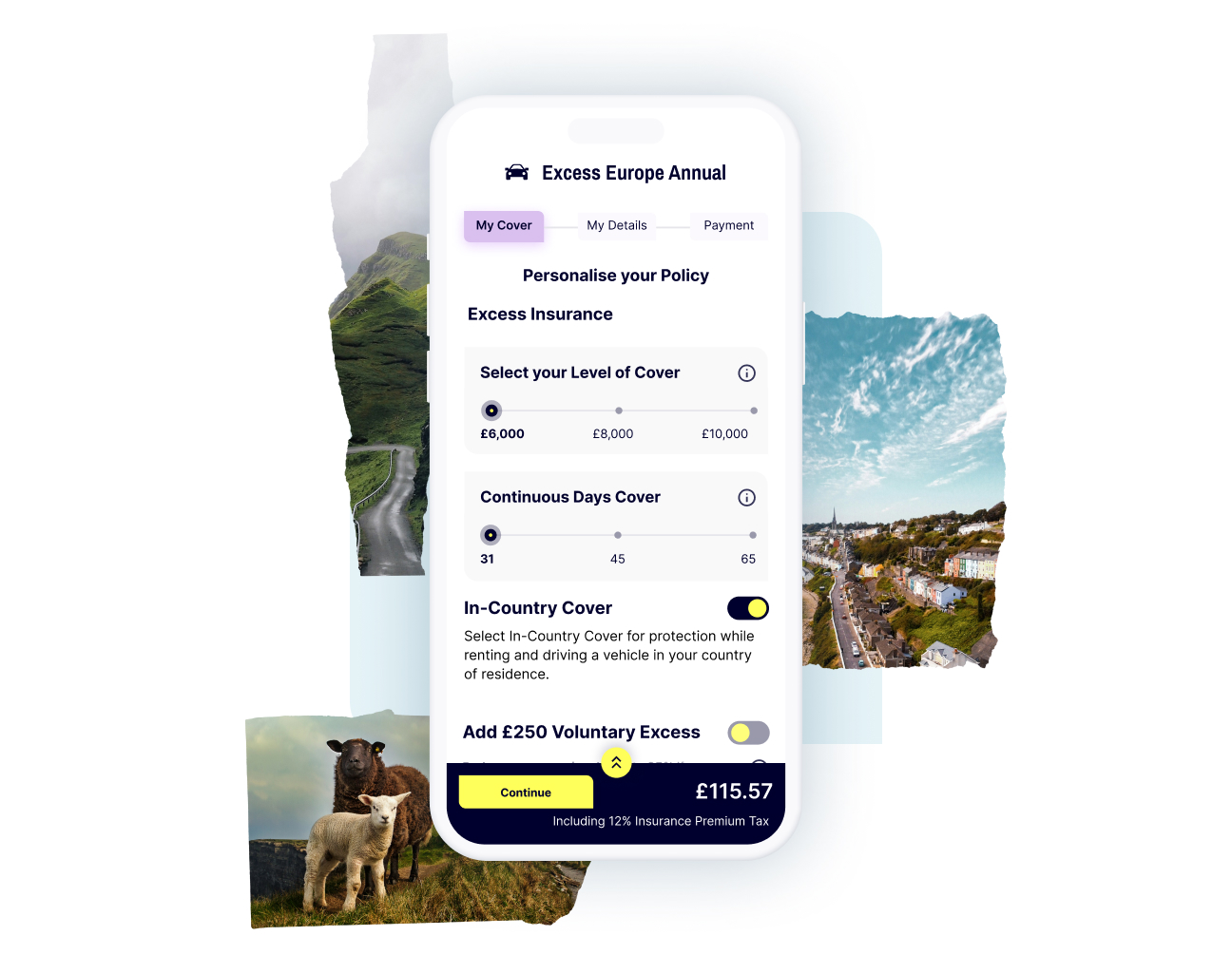

Flexibility: Flexible single-trip or annual policies – whether you need cover for a one-time Irish holiday or you’re a frequent traveller to The Emerald Isle, we have Single Trip and Annual plans to suit you. Enjoy year-round protection with an annual policy or just cover a short-term hire; it’s up to you.

- Benefits Content 2:

Peace of Mind: Our Car Hire Excess Insurance for Ireland eliminates the financial risks of hiring a car, giving you peace of mind whether you're cruising along the bustling streets of Dublin or exploring the beautiful Cliffs of Moher. Standard car hire policies often exclude tyres, windscreens, roofs, and undercarriages, leaving you vulnerable to costly repairs. With Gigasure, these crucial areas are covered, so minor issues like a chipped windscreen or a flat tyre won’t turn into expensive surprises, allowing you to enjoy your journey without the worry of unexpected costs.

Worldwide Coverage: Our Car Hire Excess Insurance isn’t just for Ireland, it can cover car rentals globally, ensuring protection both abroad and for domestic car hire adventures.

- For you Main Title: Is <span class="dark-sky">Car Hire Excess</span> Insurance for you?

- For you Image:

- For you content: If you are hiring a car, Car Hire Excess Insurance is for you. It serves as a crucial safeguard against unexpected expenses that may arise from damages, theft, or accidents involving the rental vehicle. Whether you're a frequent traveller or embarking on a one-time journey, this insurance provides peace of mind by covering the excess charges imposed by car hire companies in case of mishaps.

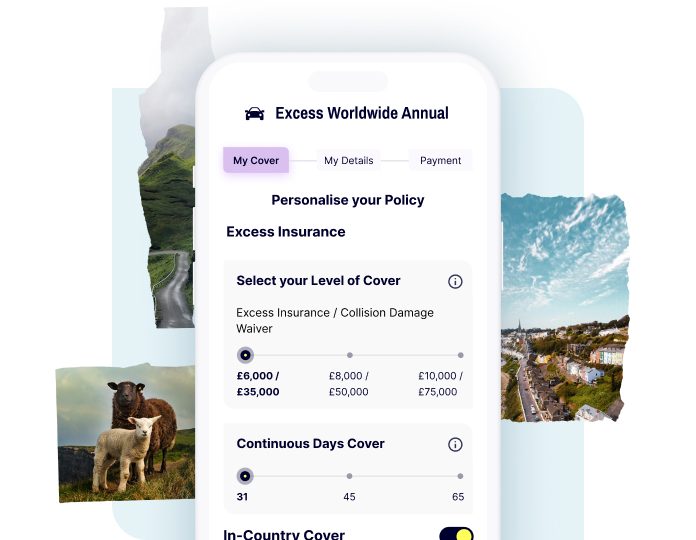

- Whats Covered Main Title: What’s covered by our Ireland <br> Car Hire Excess Insurance?

- Whats Covered Main Description: Gigasure’s Car Hire Excess Insurance for Ireland protects you from hefty excess charges if your hired vehicle is damaged, stolen, or lost, saving you from unexpected expenses and ensuring a stress-free journey. Choose from Single Trip or Annual Multi-Trip policies for flexible cover that fits your travel needs.

- Whats Covered List:

- Whats Covered List Item: Excess protection up to £10,000 – covering bodywork, tyres, roof, windscreen, and undercarriage, as well as fire damage, vandalism, and theft

- Whats Covered List Item: Misfuelling cover up to £2,000 – protection if the wrong fuel is added to the vehicle

- Whats Covered List Item: Rental Car Key Protection included as standard

- Whats Covered List Item: Up to £75,000 Collision Damage Waiver (CDW) Protection*

- Whats Covered List Item: Covers up to 9 named drivers on a single rental agreement

- Whats Covered List Item: Up to 65 whole days of continuous cover per rental under annual multi-trip policies

- Whats Covered Footnote:

*Collision Damage Waiver

available with USA & Canada

and Worldwide policies. - Whats not Covered Main Title: What's not covered?

- Whats not Covered List:

- Whats not Covered List Item: Off-road, competitive, or performance driving

- Whats not Covered List Item: Fines, penalties, or driving infractions

- Whats not Covered List Item: Rental vehicles with more than 9 seats

- Whats not Covered List Item: Rental agreements that start before your policy begins

- Whats not Covered List Item: Mechanical breakdown due to wear and tear

- Gigasure App Main Title:

The Gigasure App, your active companion

that works tirelessly by your side - Gigasure App Main Image:

- Gigasure App Main Image Mobile:

- Gigasure App Description: Whether it's activating your GigaShield benefits, chatting with us, boosting your policy, or making a claim, our app has got you covered.

- Gigasure App Tagline: Download now!

- Gigasure App Google Play Image:

- Gigasure App Google Play QR:

- Gigasure App Apple Store Image:

- Gigasure App Apple Store QR:

- Trustpilot Code:

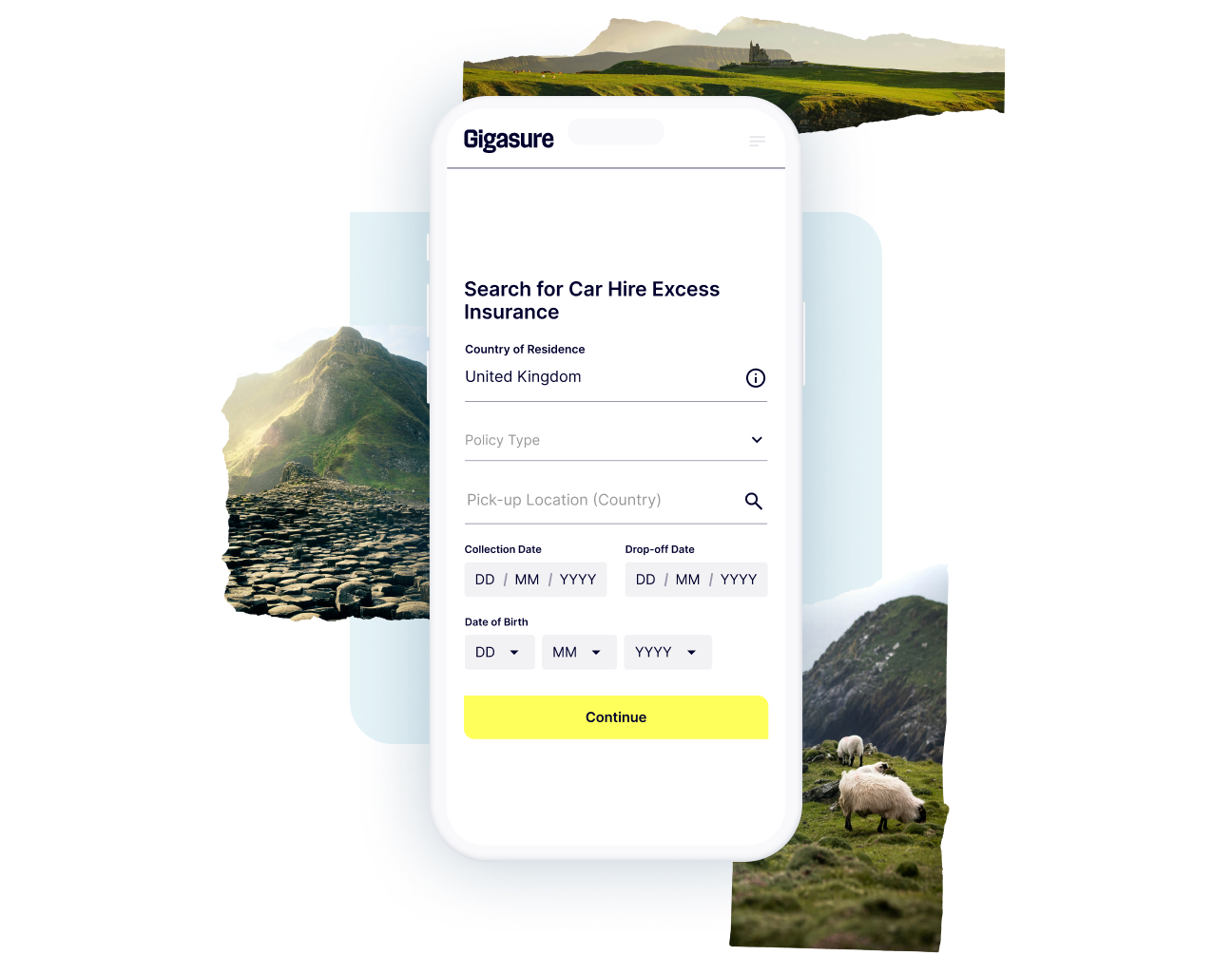

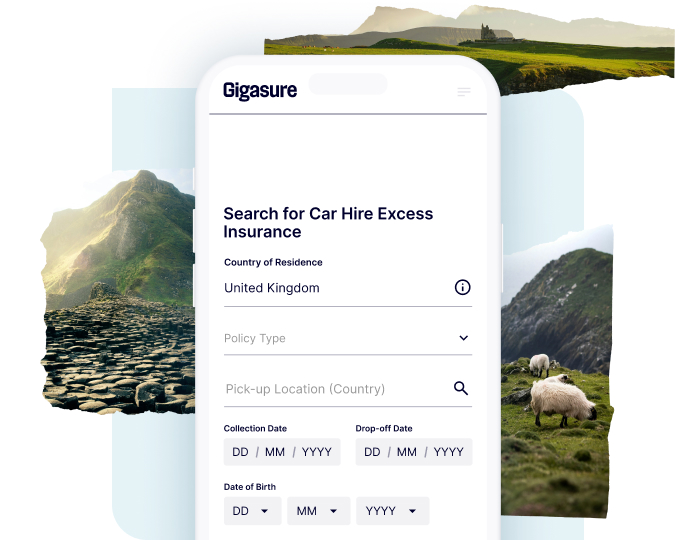

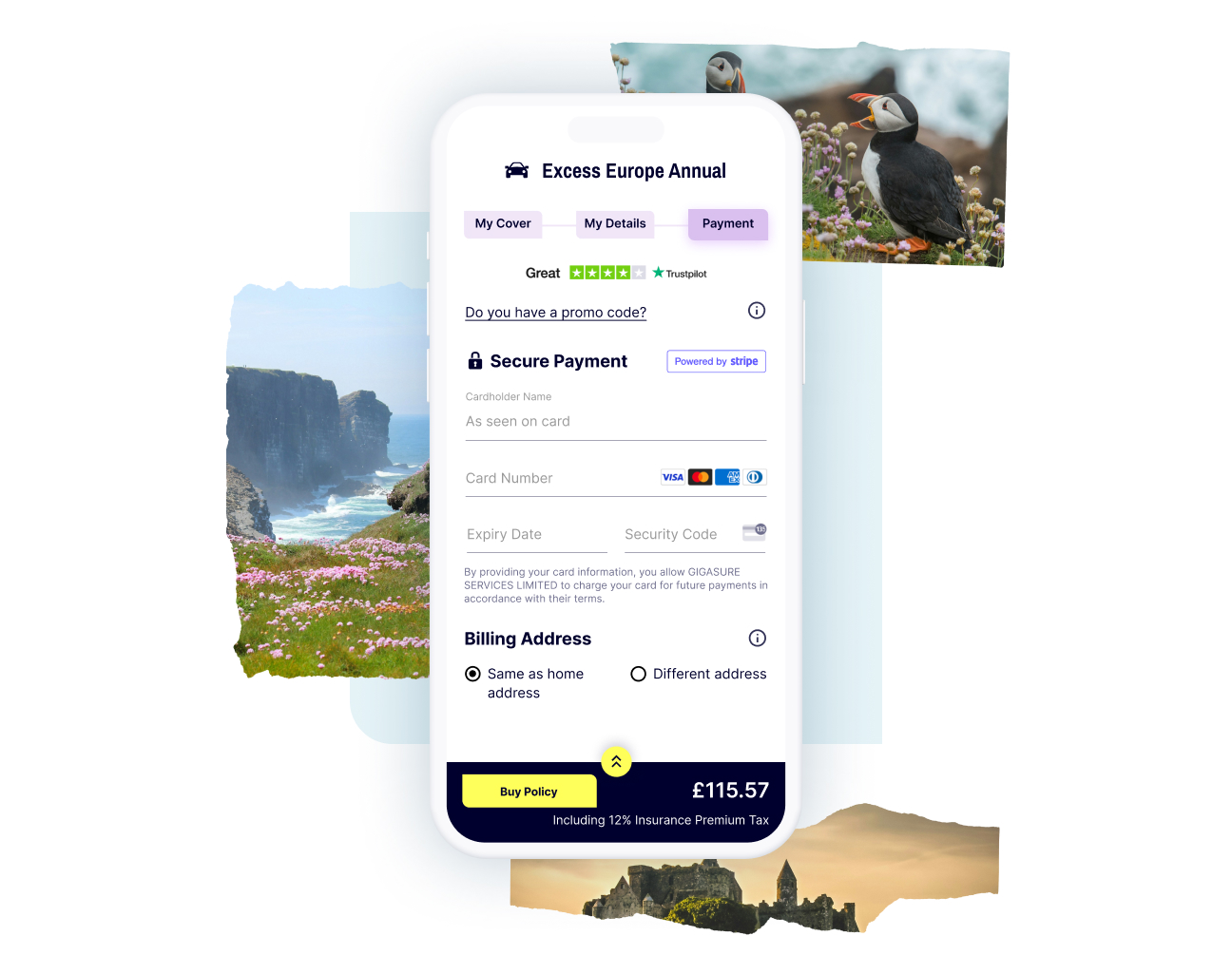

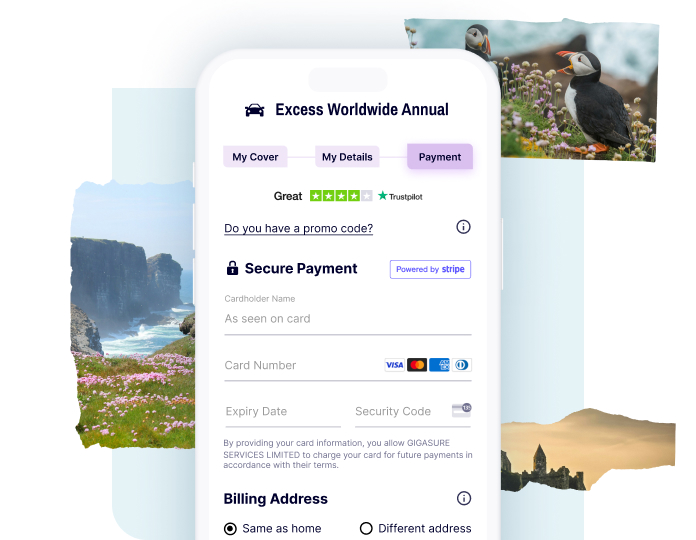

- Steps Main Title:

How to purchase Car Hire Excess

Insurance for Ireland - Steps Main Description: Buying Car Hire Excess Insurance for Ireland is very quick and straightforward. You can purchase your policy directly through our website or via the Gigasure app in just three simple steps! We also offer the option to apply a voluntary excess to reduce your premium even further. The Gigasure app allows you to get quotes, manage your policy, contact customer support, and start a claim, all in one place.